The Unseemly Rush to Power EV Batteries Could Lead to a Lithium Shortage

Power EV Batteries Could Lead

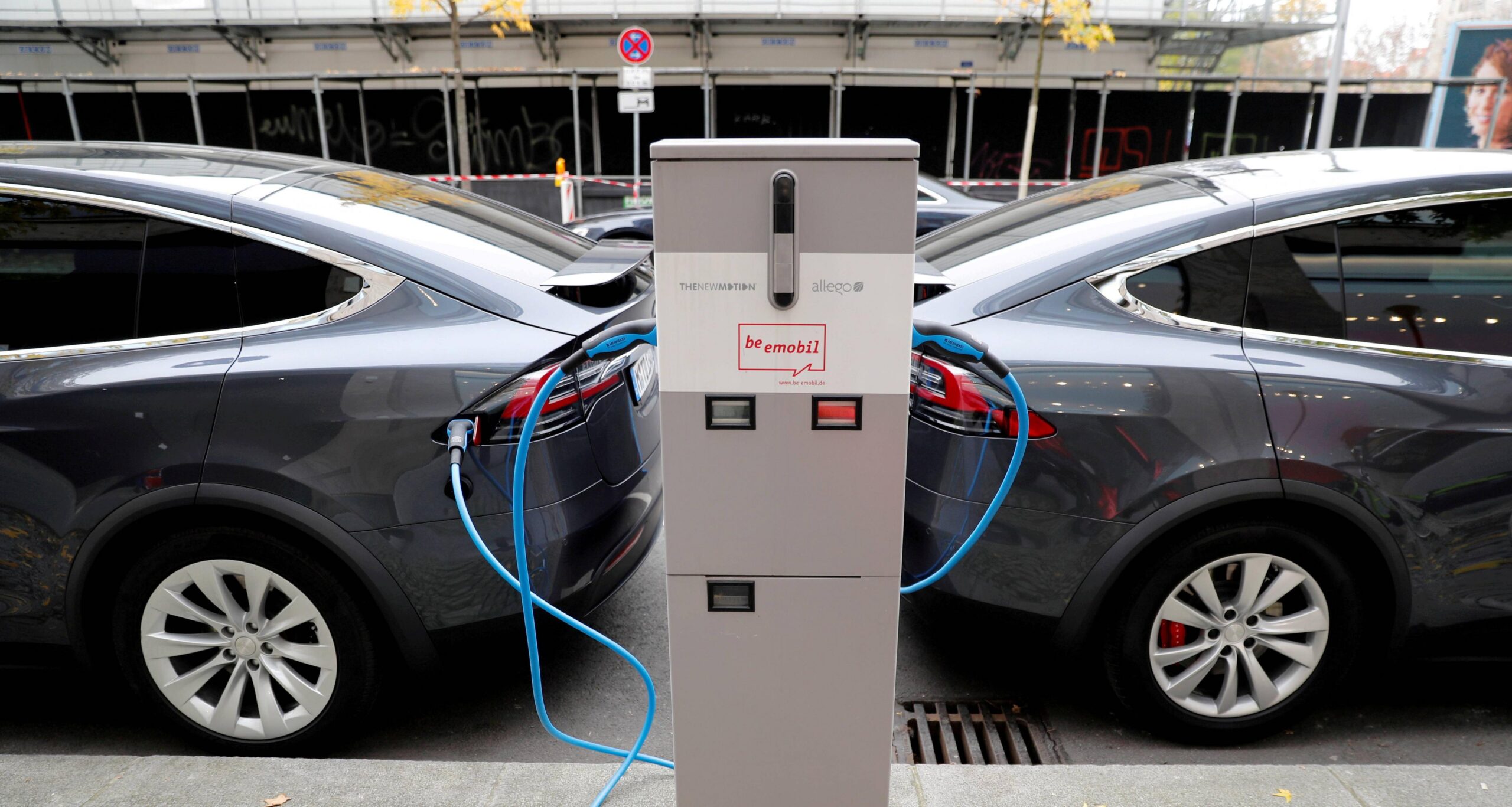

While electric vehicles may not be quite as affordable as we once thought, a growing number of manufacturers are making lithium batteries for them. As a result, there’s a frenzy to get supplies of the stuff. In early December, Tesla announced a three-year supply deal with Chinese firm Ganfeng Lithium Co., for 20 percent of the latter’s output. There was no word on the cost of that deal, which was not disclosed.

While the rush to produce battery materials is a welcome development, it is concerning that this rush could lead to a global shortage of the key ingredient in EV batteries. The main ingredient in EV batteries is lithium, and lithium prices have recently soared in China. The benchmark lithium index has more than doubled this year. While this may sound like a bad sign for the industry, it’s a natural one.

The competition for lithium has started to make EV batteries more expensive. While there are several viable substitutes for lithium, the price of the precious metal has skyrocketed. The high prices of lithium are a worrying sign for the future of the battery market. Despite the benefits of electric vehicles, they can be prohibitively expensive. While many companies are scrambling to meet the demands of consumers, there isn’t any guarantee that EVs will be able to do so.

The Unseemly Rush to Power EV Batteries Could Lead to a Lithium Shortage

With the rush to power electric vehicles, a bid war has begun to capture lithium, a potentially troublesome sign for battery supplies. Meanwhile, Tesla Inc. has signed a three-year supply agreement with Chinese company Ganfeng Lithium Co., a deal that will last for the next three years. In other words, the two companies will compete to ensure that their supply of battery-grade lithium hydroxide products are secure.

The race to power EVs has sparked a lithium shortage, and the competition is getting more intense every day. Lithium prices in China have nearly doubled this year, and it has been hard to find a reliable supplier. It’s important to understand the market for batteries, but there are some troubling signs. The lithium market is dominated by Chinese companies.

There’s a competition to capture lithium, which is a troubling sign for battery stocks. The Chinese company Ganfeng Lithium Co. has signed a three-year deal for battery-grade lithium hydroxide products. This is a warning sign. However, it’s important not to panic. There’s a market for batteries, and this is a major opportunity for investors.