What’s the Average Credit Score For Home Loans in Australia?

Average Credit Score For Home Loans in Australia

If you want to buy a home, buy a car or take out a credit card, you must know your credit score. It plays a huge role in determining your approval for a loan. Millennials have a lower credit score than older generations. They haven’t had as long to build up their credit rating and have less assets to use as collateral. Additionally, young adults who have never applied for credit before may have no credit score at all.

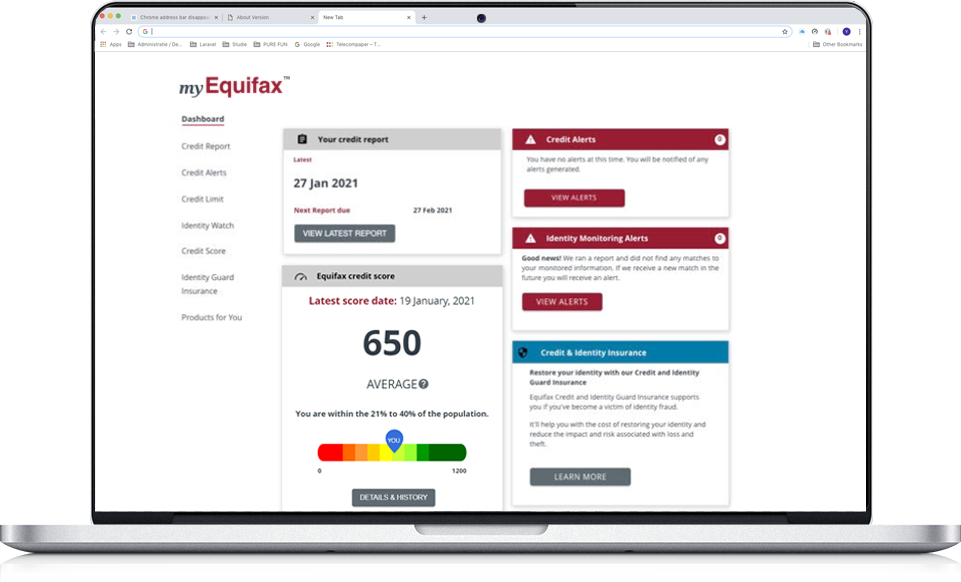

Your credit score is calculated based on your financial history and how well you repay your debt. It represents all of the information you’ve provided to financial institutions, including credit card applications and repayments. Your credit rating is a number between zero and one thousand. Your credit score is a number that will determine how much money you’ll be charged for a loan or credit card. Your credit report contains information from all three credit reporting agencies in Australia: Equifax, Experian and Dun & Bradstreet.

Australians with scores between 500 and six hundred and twenty-one have an average credit score. Those with scores between 622 and seven hundred have good credit, although lenders may require additional information from applicants to determine their risk. The average credit score for a person in Sydney may not be high enough for a loan in Perth, for example. Higher credit scores mean lower interest rates, but they are also riskier to lenders than those with lower scores.

What’s the Average Credit Score For Home Loans in Australia?

Taking the time to pay your debts and bills on time will increase your credit score. This is because positive credit reporting is required in Australia and gives lenders a clearer picture of your financial habits. It will also help you qualify for better loans. You can even refinance your home loan to get a lower interest rate. If you don’t meet these requirements, there are still ways to improve your score. Creating a budget and setting a reminder to pay bills on time are two things you can do to boost your credit score. If you are still concerned, consider settling your outstanding debts and reducing your debts to get a better credit rating.

Your credit score is one of the most important factors when you apply for a home loan. Lenders evaluate your credit score to determine whether you are a risk for default. It’s a number that ranges from -200 to one thousand and tells them how likely you are to repay your loan on time. It’s also a way to decide whether you can afford to pay your loan. If you have a higher credit score, you’re better off.

Although there are a variety of credit scores in Australia, the minimum credit score is usually 500. A lower score is an indication that your financial stability is risky. Lenders often require borrowers with bad credit home loans australia to pay higher interest rates than those with good credit. This can cause a loan application to be rejected or face additional fees. However, the best way to improve your credit score is to work with an expert lender.